The Federal Reserve did exactly what markets expected today, keeping the fed funds rate unchanged at 3.50-3.75% following three consecutive cuts last year. The decision was largely a non-event, but the 10-2 vote revealed continuing fault lines within the FOMC—Governors Waller and Miran dissented in favor of a quarter-point cut, with Miran notably scaling back from his December call for 50 basis points. The new 2026 voting roster skews more hawkish, and the statement's upgrade of economic growth from "modest" to "solid" reinforced expectations that we're in for an extended pause.

Chair Powell's press conference was unremarkable from a policy standpoint. He noted the economy is "coming into 2026 on a firm footing" CNBC and characterized recent inflation pressures—including tariff-related noise—as likely transitory. CME FedWatch shows March cut odds hovering around 15%, with markets broadly expecting no action until June at the earliest. Goldman's take: solid activity and labor market stabilization reduce the urgency for further "insurance" cuts.

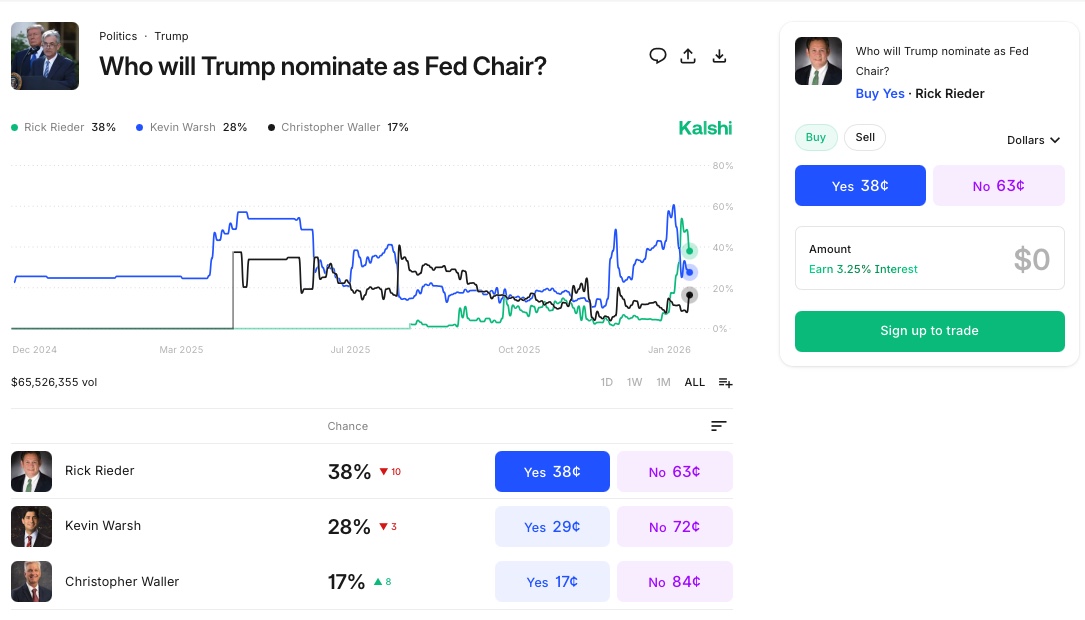

The more interesting drama surrounds Powell's successor. With Powell's term winding down and the administration's self-imposed January deadline slipping, speculation continues to swirl around Warsh, Hassett, Waller, and the surprise dark horse Rick Rieder from BlackRock. Jeffrey Gundlach offered his two cents today, suggesting he'd lean toward Waller as "less likely to be manipulated," while cautioning that what really matters is fiscal rectitude and a steady hand on the dollar. His broader point—echoed in his DoubleLine roundtable—is worth noting: investors are getting more sober and gravitating toward things that are "real" rather than hype. Whether the next Fed chair can maintain that credibility amid political crosscurrents will matter far more than any single rate decision.